The devastation in South East Texas on account of Hurricane Harvey has residents and neighbors working day and night to dry out and recover what they can. The IRS has loosened some retirement plan rules to help with the hardships being endured…

The devastation in South East Texas on account of Hurricane Harvey has residents and neighbors working day and night to dry out and recover what they can. The IRS has loosened some retirement plan rules to help with the hardships being endured…

“The Internal Revenue Service granted additional relief to victims of Hurricane Harvey on Wednesday by allowing 401(k)s and other employer-sponsored retirement plans to give loans and hardship distributions to aid them without incurring penalties…” [ Read more here ]

Tax time may not be everyone’s favorite time of the year, but at

Tax time may not be everyone’s favorite time of the year, but at

Get the help your business needs dealing with the IRS – Sterling Accounting is your solution for all your financial, accounting, bookkeeping, and payroll needs to keep your business operating smoothly and with ease.

Get the help your business needs dealing with the IRS – Sterling Accounting is your solution for all your financial, accounting, bookkeeping, and payroll needs to keep your business operating smoothly and with ease. Want to skip the court room with your IRS tax issues? It may be an option on the table soon, as the IRS is planning out an online tax appeals conference system to aid your battle…

Want to skip the court room with your IRS tax issues? It may be an option on the table soon, as the IRS is planning out an online tax appeals conference system to aid your battle…

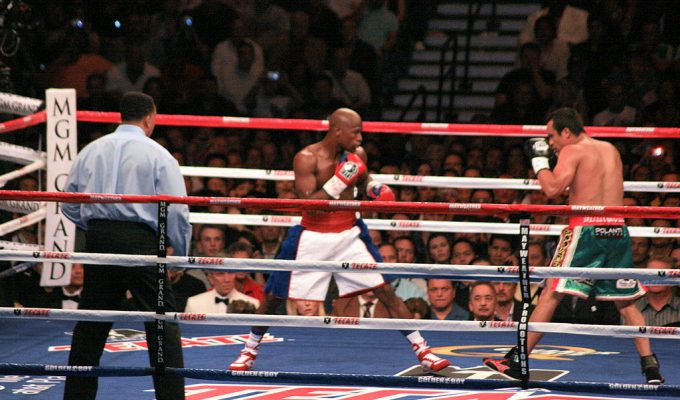

It seems the numbers surrounding the Floyd Mayweather vs IRS situation is getting murkier, as the IRS is being forced to lay off the boxer following a big chunk of cash he paid out… “A new report says that

It seems the numbers surrounding the Floyd Mayweather vs IRS situation is getting murkier, as the IRS is being forced to lay off the boxer following a big chunk of cash he paid out… “A new report says that

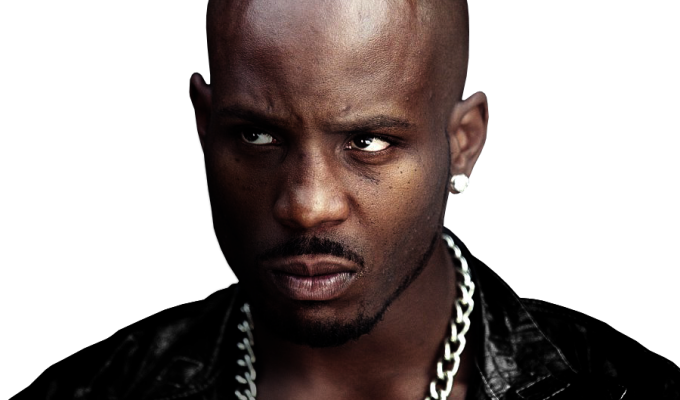

With accusations that he owes the Internal Revenue Service, rapper DMX has declared his innocence over owing $1.7 million. “The rapper, 46, pleaded not guilty Friday in federal court in New York to 14 charges related to tax fraud. He was to be released after posting $500,000 bond…” [

With accusations that he owes the Internal Revenue Service, rapper DMX has declared his innocence over owing $1.7 million. “The rapper, 46, pleaded not guilty Friday in federal court in New York to 14 charges related to tax fraud. He was to be released after posting $500,000 bond…” [

The IRS suspended PTIN registration and renewal at the beginning of this month, following continued court battles over it’s fees…

The IRS suspended PTIN registration and renewal at the beginning of this month, following continued court battles over it’s fees…