With the tax debate in full swing, the question arises – would cutting taxes affect the economy in a beneficial way? Americans for Tax Reform President Grover Norquist takes a dive into the controversy on Fox Business:

Tag: tax services

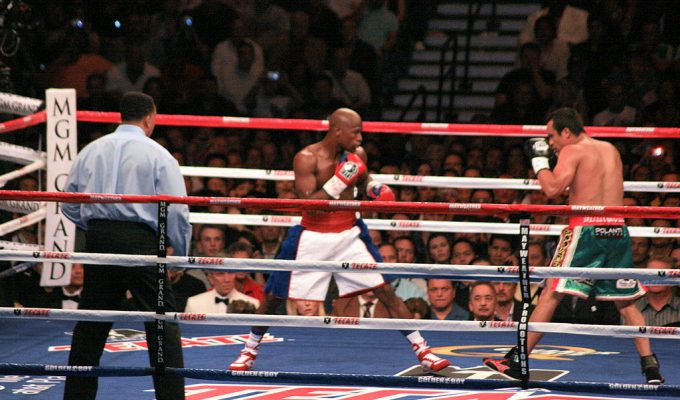

IRS Lays Off Floyd Mayweather Following Reported Pay Off

It seems the numbers surrounding the Floyd Mayweather vs IRS situation is getting murkier, as the IRS is being forced to lay off the boxer following a big chunk of cash he paid out… “A new report says that Floyd Mayweather’s $3.3 Mill tax lien has been released by the IRS, even though he appears to still owe the IRS a whopping $29 million. If true, it might make you wonder why the IRS often pushes so relentlessly to collect, but seems to ease off in some cases…” [ Read more here ]

It seems the numbers surrounding the Floyd Mayweather vs IRS situation is getting murkier, as the IRS is being forced to lay off the boxer following a big chunk of cash he paid out… “A new report says that Floyd Mayweather’s $3.3 Mill tax lien has been released by the IRS, even though he appears to still owe the IRS a whopping $29 million. If true, it might make you wonder why the IRS often pushes so relentlessly to collect, but seems to ease off in some cases…” [ Read more here ]

Don’t Get Wrapped Up In Federal Payroll Tax Troubles

Your personal taxes can be daunting enough of a task… but if you’re on the books for payroll taxes to your employee’s the IRS will likely be keeping a watchful eye over your activities…

Your personal taxes can be daunting enough of a task… but if you’re on the books for payroll taxes to your employee’s the IRS will likely be keeping a watchful eye over your activities…

“Payroll taxes are withheld from wages and are to be promptly paid to the government. This is trust fund money that belongs to the government, and no matter how good a reason the employer has for using the money for something else, the IRS is strict…” [ Read more here ]

Try Not To Follow Floyd Mayweather’s Tax Strategy…

Reports from Law 360 are putting Floyd Mayweather’s tax strategy to shame, showing the boxer is in the process of paying down some big debts…

“Despite making $700 million during his career, Mayweather has asked for “a short-term installment agreement of under three months” to pay an amount that the Associated Press has pegged at $22,238,255. Reporter Oskar Garcia even posted the Internal Revenue Service lien against Mayweather on Twitter for context…” [ Read more here ]

Here’s IRS lien against Mayweather. Says he owes $22,238,255 from 2015, when he fought Pacquiao. https://t.co/ObkR2ljOjV #MayweatherMcGregor pic.twitter.com/WGyXKkotVW

— Oskar Garcia (@oskargarcia) July 11, 2017

Leave The Business Accounting To The Experts At Sterling!

Sterling Accounting is your one stop shop for cutting through the mess of paperwork, account management, payroll, and the dreaded tax time. Get the financial experts on your side and open up time to focus on extending the horizon’s of your business!

Follow Sterling Accounting on Twitter for the latest news and updates.

Hear From The Man Who Hasn’t Filed Taxes In Five Years

After banking in big with his gambling addiction, one man decided he wasn’t going to pay up when tax time came. Five years later – he’s ready to face his troubling decision. Hear his story as he called in and got some advice on The Dave Ramsey Show:

IRS Reopens PTIN System As Court Battles Continue

The IRS suspended PTIN registration and renewal at the beginning of this month, following continued court battles over it’s fees…

The IRS suspended PTIN registration and renewal at the beginning of this month, following continued court battles over it’s fees…

“The Internal Revenue Service reopened its Preparer Tax Identification Number system Wednesday after closing it earlier this month because it lost a lawsuit over registration and renewal fees…” [ Read more here ]

Gas Tax Hikes Proposed In Some States For Transportation Improvements

A number of states have begun implementing some new taxes on gasoline, using the funds to work on transportation services that are much needed. California is among one, with the governor proposing a 12 cent hike.

A number of states have begun implementing some new taxes on gasoline, using the funds to work on transportation services that are much needed. California is among one, with the governor proposing a 12 cent hike.

“Montana, Indiana, Tennessee and South Carolina are the other states that passed gas tax hikes this year. Several other state legislatures that are still in session are considering their own measures…” [ Read more here ]

Staying On The Right Side Of The Law With Your Business Taxes

Taxes are hard enough for a novice when filing a personal form, but when you also have to take the time to understand your business taxes, things can get a bit blurry. Cut through the paperwork and leave it to the professionals at Sterling Accounting. “There are different levels of taxes to remit, depending on the kind of business. These facts should be confirmed by speaking to an accountant, as well as the frequency the business is mandated to remit them. There are state and federal taxes, and specified taxes that must be remitted to either of them…” [ Read more here ]

Taxes are hard enough for a novice when filing a personal form, but when you also have to take the time to understand your business taxes, things can get a bit blurry. Cut through the paperwork and leave it to the professionals at Sterling Accounting. “There are different levels of taxes to remit, depending on the kind of business. These facts should be confirmed by speaking to an accountant, as well as the frequency the business is mandated to remit them. There are state and federal taxes, and specified taxes that must be remitted to either of them…” [ Read more here ]

IRS Issues Relief For Estate Tax Trap For Surviving Spouses

The IRS has come to a ruling in their efforts to protect surviving spouses from an estate tax trap by overlooking regulations.

The IRS has come to a ruling in their efforts to protect surviving spouses from an estate tax trap by overlooking regulations.

“Congress added portability to the estate tax law when it settled on a “permanent” exclusion of $5 million per person (indexed for inflation) and a flat tax rate of 40%, effective 2011. It lets a surviving spouse essentially carry over any unused portion of the deceased spouse’s exclusion…” [ Read more here ]