Tax time may not be everyone’s favorite time of the year, but at Sterling Accounting, there’s no lost sleep! Don’t run into troubles with the IRS over your taxes – be sure you are going to rank on their good side with the expert help of Sterling Accounting.

Tax time may not be everyone’s favorite time of the year, but at Sterling Accounting, there’s no lost sleep! Don’t run into troubles with the IRS over your taxes – be sure you are going to rank on their good side with the expert help of Sterling Accounting.

“More Americans who pay their income taxes each quarter are being penalized by the IRS for making mistakes or missing payments.

There’s been a nearly 33% jump — from almost 7.5 million to nearly 10 million — in the number of penalties levied between fiscal years 2007 and 2016, IRS data show…” [ Read more here ]

Are we likely to see a tax shakeup with the proposed reform taking place this year? Tax professional’s aren’t all that certain… “Nearly two-thirds of the survey respondents (63.5 percent) said compromise in Congress is most needed to ensure passage of tax reform. For the survey, Deloitte polled more than 3,100 attendees during a webinar last month….” [

Are we likely to see a tax shakeup with the proposed reform taking place this year? Tax professional’s aren’t all that certain… “Nearly two-thirds of the survey respondents (63.5 percent) said compromise in Congress is most needed to ensure passage of tax reform. For the survey, Deloitte polled more than 3,100 attendees during a webinar last month….” [

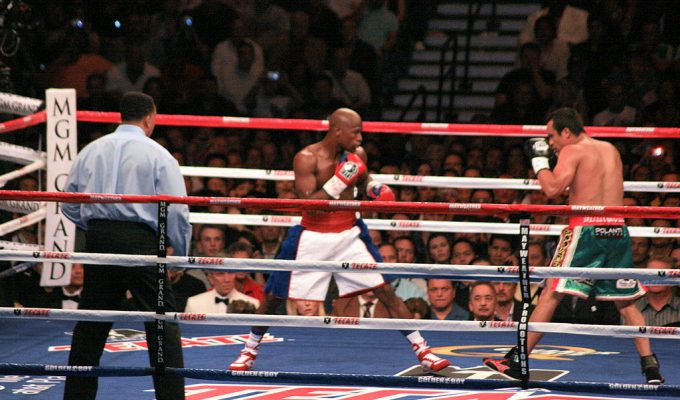

It seems the numbers surrounding the Floyd Mayweather vs IRS situation is getting murkier, as the IRS is being forced to lay off the boxer following a big chunk of cash he paid out… “A new report says that

It seems the numbers surrounding the Floyd Mayweather vs IRS situation is getting murkier, as the IRS is being forced to lay off the boxer following a big chunk of cash he paid out… “A new report says that

What is an Insurance Dedicated Fund (IDF)? Many are finding that this practice is a safe way of avoiding some big taxes…

What is an Insurance Dedicated Fund (IDF)? Many are finding that this practice is a safe way of avoiding some big taxes…

The IRS suspended PTIN registration and renewal at the beginning of this month, following continued court battles over it’s fees…

The IRS suspended PTIN registration and renewal at the beginning of this month, following continued court battles over it’s fees…

A number of states have begun implementing some new taxes on gasoline, using the funds to work on transportation services that are much needed. California is among one, with the governor proposing a 12 cent hike.

A number of states have begun implementing some new taxes on gasoline, using the funds to work on transportation services that are much needed. California is among one, with the governor proposing a 12 cent hike.

Taxes are hard enough for a novice when filing a personal form, but when you also have to take the time to understand your business taxes, things can get a bit blurry. Cut through the paperwork and leave it to the professionals at

Taxes are hard enough for a novice when filing a personal form, but when you also have to take the time to understand your business taxes, things can get a bit blurry. Cut through the paperwork and leave it to the professionals at