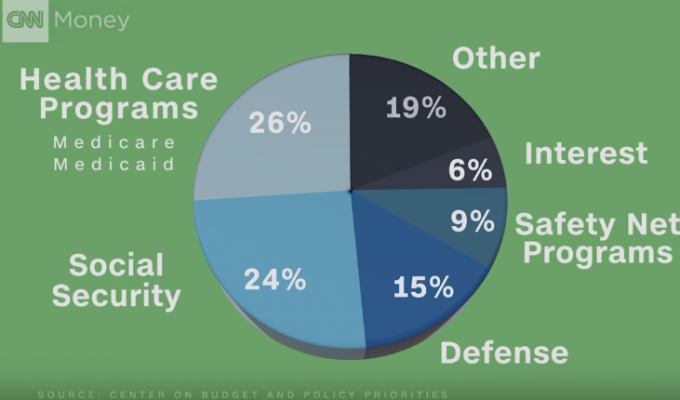

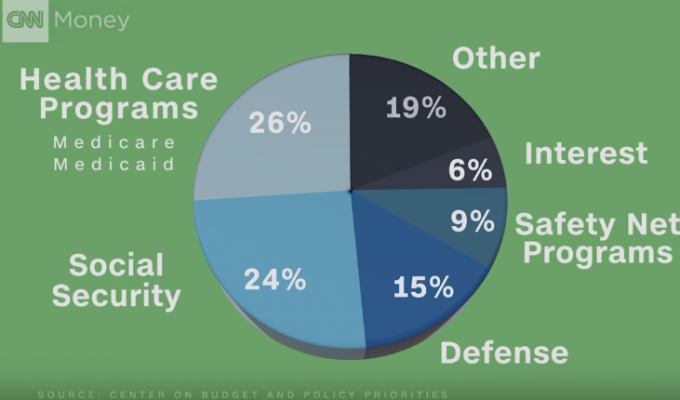

Tax changes have dominated the headlines in the financial world, with President Trump issuing a number of alterations. Between defense costs, healthcare, social services and more, let’s break down where your tax dollars are going…

Are you spending too much time keeping the books, and not focusing on growing your business? The financial team, at Sterling Tax & Accounting Services, with over 15 years experience is waiting to help you with:

Accounts Receivable, Accounts Payable, Accounts Reconciliation, QuickBooks® Set Up and Training, Small Business Payroll, Processing Small Business Quarterly Tax Reporting, Annual Government Filing, Financial Statements, and More!

I know… the last thing you want to start thinking about again are next years taxes after just filing your 2016. Let the worry subside and get the help of Sterling Accounting to handle all your tax needs.

“You may think it’s too early to start thinking about your 2017 tax return, but in fact, planning right from the beginning of the year gives you the greatest opportunity to save money on your taxes…” [ Read more here ]

With tax reform taking over the headlines in recent weeks, The Wall Street Journal is looking into what the possible outcomes for the changes could amount to, and what can impact the changes that we see in the near future…

Let Sterling Accounting take over your office needs, so you can put that time into focusing to grow your business! From bookkeeping, to payroll and tax filing, don’t get caught up in time killing activities around the office.

And follow Sterling Accounting on Facebook today for the latest news and updates!

Don’t take on your taxes alone, from business and corporate needs, to personal tax filing – the experts at Sterling Accounting will handle your accounting needs as if you were family. Contact them today!

“The Internal Revenue Service’s new process for verifying information from W-2 forms did not go completely smoothly this past tax season, although it did hold promise for combating identity theft and tax fraud…” [ Read more here ]

The Internal Revenue Service collects unfathomable amounts of money for our government every year, but where are those tax dollars going? While working to pay our government officials, protect our country, and more – there turns out there is also a lot of wasted spending going on…

The federal tax code is about to undergo some big changes which have been proposed by President Donald Trump. How will going from seven brackets down to the suggested three affect your pocket?

What’s your credit score? Credit bureaus are shaking up the way we borrow money, looking to change up their scoring model. “A new credit scoring model — expected to roll out in fall 2017 — aims to more accurately measure credit risk by using more historical data and machine-learning techniques while culling less reliable information….” [ Read more here ]

Sterling Accounting is your one stop shop for cutting through the mess of paperwork, account management, payroll, and the dreaded tax time. Get the financial experts on your side and open up time to focus on extending the horizon’s of your business!

Follow Sterling Accounting on Twitter for the latest news and updates.